Coupon Rate Formula

You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution. Let us assume a company XYZ Ltd has issued a bond having a face value of 1000 and quarterly interest payments of 15.

Coupon Rate Formula And Bond Yield Calculator

Select a blank cell for instance the Cell C2 type this formula B2-A2ABSA2 the Cell A2 indicates the original price B2 stands the sales price you can change them as you need into it.

. Finally the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100 as shown below. N is the number of years until maturity. The bond paid coupon at the rate of 6 per annum for the next 10 years until its maturity on December 31 2014.

The following formula is to calculate the discount rate. In reality zero-coupon. To calculate the price of a zero-coupon bond use the following formula.

25 2 50. Note that the formula above assumes that the interest rate is compounded annually. Let us take the example of a bond with quarterly coupon payments.

What is the RATE Function. Coupon Rate is the interest rate that is paid on a bondfixed income security. For a financial analyst the RATE function can be useful to calculate the interest rate on zero coupon bonds.

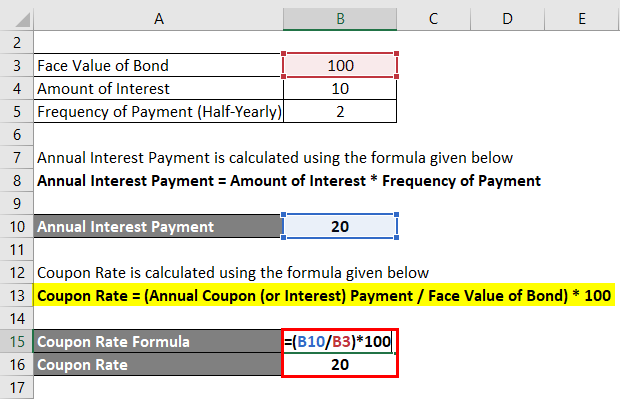

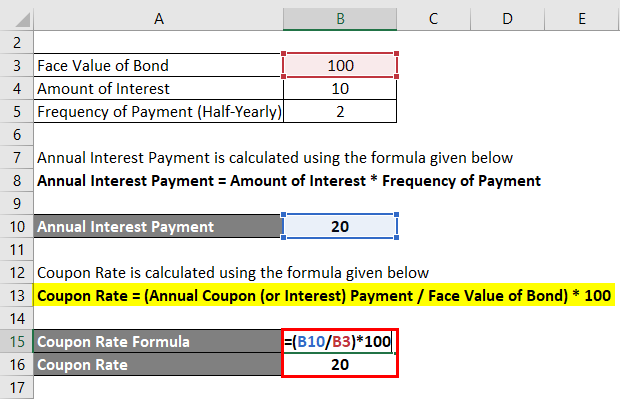

It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity. Examples of Coupon Rate Formula With Excel Template Coupon Rate Formula Calculator. The last step is to calculate the coupon rate.

Calculate discount rate with formula in Excel. And the annual coupon payment for Bond A is. Coupon rate annual coupon payment.

Calculate the annualized rate of return earned by the investor from the bond investment. The RATE Function is an Excel Financial function that is used to calculate the interest rate charged on a loan or the rate of return needed to reach a specified amount on an investment over a given period. You can find it by dividing the annual coupon payment by the face value.

Calculate the coupon rate. Type the original prices and sales prices into a worksheet as shown as below screenshot. The coupon rate is the annual income an investor can expect to receive while holding a particular bond.

Face value is the future value maturity value of the bond. R is the required rate of return or interest rate. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage.

As this is a semi-annual coupon bond our annual coupon rate calculator uses coupon frequency of 2. Coupon Rate Total Annual Coupon Payment Par Value of Bond 100. At the time it is purchased a bonds yield to maturity and its coupon rate are the same.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

How Can I Calculate A Bond S Coupon Rate In Excel

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Coupon Rate Formula Calculator Excel Template

Coupon Rate Formula Calculator Excel Template

0 Response to "Coupon Rate Formula"

Post a Comment